Facts About Life Insurance Louisville Ky Uncovered

The Greatest Guide To Child Whole Life Insurance

Table of ContentsMore About Life Insurance Companies Near MeThe Single Strategy To Use For Whole Life InsuranceSome Ideas on Kentucky Farm Bureau You Should KnowThe Buzz on Life Insurance Quote OnlineAll about Child Whole Life InsuranceThe Ultimate Guide To Life Insurance Companies Near MeChild Whole Life Insurance - An Overview5 Simple Techniques For Life Insurance CompanyThe Of Senior Whole Life Insurance

The franchise business agreement requires that he directly contract for "all necessary insurance" for the effective operation of the franchise business. He expects to have twelve staff members, five full time and 7 part-time (the distribution people), at his location, which will be on an active blvd in Lubbock and will certainly use take-out only.What type of insurance coverage will be "required"?. Life insurance companies near me.

Top Guidelines Of Life Insurance Companies Near Me

There are different sorts of Industry health and wellness insurance coverage prepares designed to fulfill different demands. Some kinds of strategies limit your carrier choices or encourage you to get care from the strategy's network of physicians, hospitals, pharmacies, as well as other clinical provider. Others pay a greater share of prices for companies outside the strategy's network.

Some instances of plan kinds you'll find in the Market: A managed treatment strategy where solutions are covered only if you make use of medical professionals, specialists, or health centers in the plan's network (except in an emergency situation). A sort of medical insurance strategy that generally limits protection to care from physicians who benefit or agreement with the HMO.

Life Insurance Online Fundamentals Explained

An HMO might require you to live or work in its service area to be eligible for protection. HMOs usually supply incorporated treatment and focus on prevention and wellness. A sort of strategy where you pay much less if you utilize doctors, medical facilities, as well as various other wellness care suppliers that come from the plan's network.

A sort of health insurance plan where you pay less if you make use of suppliers in the plan's network. You can use doctors, hospitals, and also companies outside of the network without a referral for an added price. Get more information on what you must recognize regarding supplier networks (PDF) - Term life insurance Louisville. See our Dental insurance coverage in the Industry web page to get more information concerning options readily available to you.

10 Easy Facts About Life Insurance Online Shown

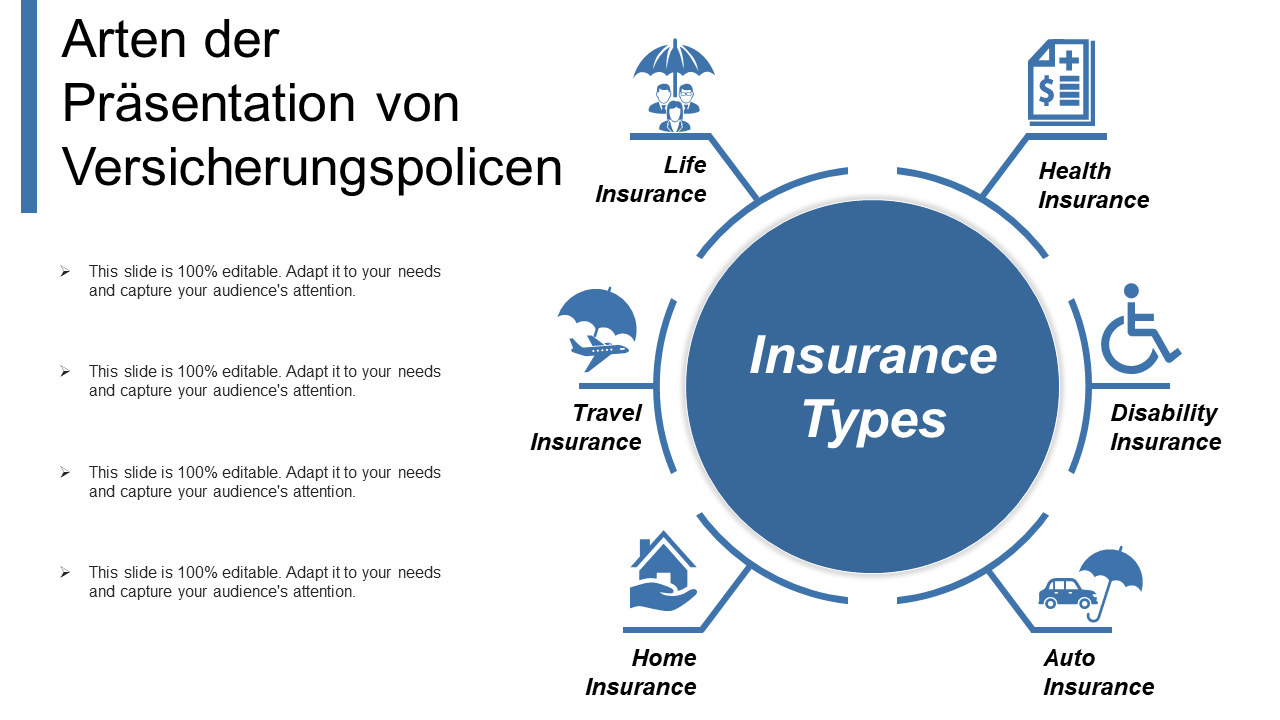

There are various insurance options, and numerous monetary specialists will certainly state you need to have them all. It can be challenging to determine what insurance you actually require.

Variables such as children, age, lifestyle, and employment benefits play a role when you're building your insurance policy profile. There are, nonetheless, four types of insurance coverage that most economic professionals advise we all have: life, health and wellness, automobile, and long-term impairment. American Income Life. 4 Kinds Of Insurance Everyone Requirements Life Insurance policy The best advantages of life insurance coverage include the ability to cover your funeral costs and also offer those you leave behind.

Getting The Senior Whole Life Insurance To Work

Market experts suggest a life insurance policy policy that covers 10 times your annual income. However that's a number not everyone can manage. When estimating the quantity of life insurance protection you need, bear in mind to consider not only funeral costs, yet also daily living costs. These might consist of home mortgage payments, superior finances, credit history card debt, taxes, day care, and also future college costs.

Merely clarified, whole life can be utilized as an earnings tool as well as an insurance tool. Term life, on the various other hand, is a policy that covers you for a collection amount of time.

Everything about Life Insurance Louisville Ky

However with rising co-payments, increased deductibles, as well as went down insurance coverages, health insurance policy has come to be a luxury fewer as well as fewer people can afford. When you take into consideration that the national ordinary price for one day in the medical facility was $2,517 in 2018, even a marginal policy is better than none. The finest and least costly alternative may be joining your company's insurance policy program, yet lots of smaller businesses do not use this benefit.

See This Report on Life Insurance Company

If you do not have health and wellness insurance coverage with an employer, check with trade companies or organizations regarding possible group wellness coverage.

Often, also those employees who have terrific medical insurance, a nice savings, and an excellent life insurance coverage policy do not get ready for the day when they may not be able to help weeks, months, or ever again. While wellness insurance spends for hospitalization and clinical expenses, you're still entrusted to those day-to-day costs that your paycheck usually covers.

Examine This Report on American Income Life

The cost of impairment insurance coverage is based on numerous elements, including age, lifestyle, and health. The typical price is 1% to 3% of your yearly wage - Child whole life insurance. But prior to you purchase, check out the small print. Many strategies need a three-month get more waiting duration before insurance coverage kicks in, offer a maximum of three years' well worth of coverage, as well as have some considerable plan exemptions.

What Does Life Insurance Quote Online Do?

7 million automobile accidents in the united state in 2018, according to the National Freeway Traffic Security Management. Life insurance quote online. An estimated 38,800 people died in auto accident in 2019 alone. The top cause of fatality for Americans in between the ages of five and 24 was vehicle mishaps, according to 2018 CDC information.